The global leader in trader training.

STOP - See How You Can Follow Wall Street's Smart Money

How the Smartest Wall Street Traders Can Give Everyday Traders Like Us Massive Results

Professional Traders...

These are the people we love to hate. The professional traders who trade for the big institutions.

Institutions like "Gold-mine Sachs", which made $47.3 billion last year.

How is that remotely possible?

$47 Billion?!?

These institutional traders are the same people who made billions leading up to the 2008 financial crisis that left a lot of people out of work and at risk of losing their homes.

In fact a lot of people DID lose their homes.

When you are in Chicago or New York and you see those twentysomethings pull up to the valet at the steakhouse in shiny new Ferraris, guess what they do for a living?

Social Media Influencer? Nah, not likely. They're traders.

And then there are the high-frequency traders whose firms pay $10 million to build microwave towers so their orders get to the exchange before yours by 3 milliseconds and you're left out in the cold.

How can we compete?

One thing that is undeniable is that they're smart...

You don't get to that level without having figured some stuff out.

We still don't have to like them...or trust them...

We can still disparage them every chance we get. But they make money because they know exactly how to do it. The bad guys.

Turning the Tables: How We Get the Wall Street Pros to Send US Their BEST Trades EVERY DAY.

But are these institutional traders truly the "Bad Guys"???

Here's why those some would call "Bullies" can actually be our friends...

From today forward, these traders are going to help us with our trading every day.

Imagine that for a minute...

These traders...

The ones putting millions of dollars on the line every day with confidence...

The ones who are paid millions of dollars in bonuses every quarter...

The traders who have their trades backed by the smartest researchers and analysts with the most well-connected insiders.

"The pro traders are going to help us with our trading every single day."

They are going to do all the work...

The research...DONE.

The technical analysis...DONE.

The volatility analysis...DONE.

The pricing...DONE.

Everything they do to put on a high-confidence trade they do it for a mega-million- dollar bonus.

And the BIG SECRET is they don't even know that they're doing it for us too.

Here's why.

Whenever they make a trade that meets a specific, proven and proprietary criteria...

We see it...

In REAL TIME.

And we can follow along (or not).

This is high-probability trading at its finest.

The experts with the best research, the most skill and really the most to lose (their livelihoods) wouldn't make these trades unless they have CONFIDENCE.

Because, let's face it...

Even pro-level traders don't want to go upstairs to their boss and tell them they lost millions of dollars on a bad trade. They avoid bad trades (as best they can).

They do this by backing their trades with the best research money can buy and the most talented analysts...and their absolute best trading skills that they've developed over years, possibly decades.

And when we see these trades in real time, it's like we have access to the same research desks...

The same analysts...

The same industry insiders...

The same bulletproof trading strategies...

The same confidence...

The same consistency.

It's ours. All we have to do is follow along.

But can it really be that simple???

"The BIG SECRET is they don't even know they're doing it for us."

It can be that easy...Here's why...

The trades the pro traders are sending our way are Credit Spreads.

These are naturally a high-probability trades. We get an edge with Credit Spreads.

And when we pair the natural edge of a credit spread with the skill, knowledge and expertise of a pro-trader we tip the scales in our favor even more.

You see, with a regular credit spread we have a high probability of winning.

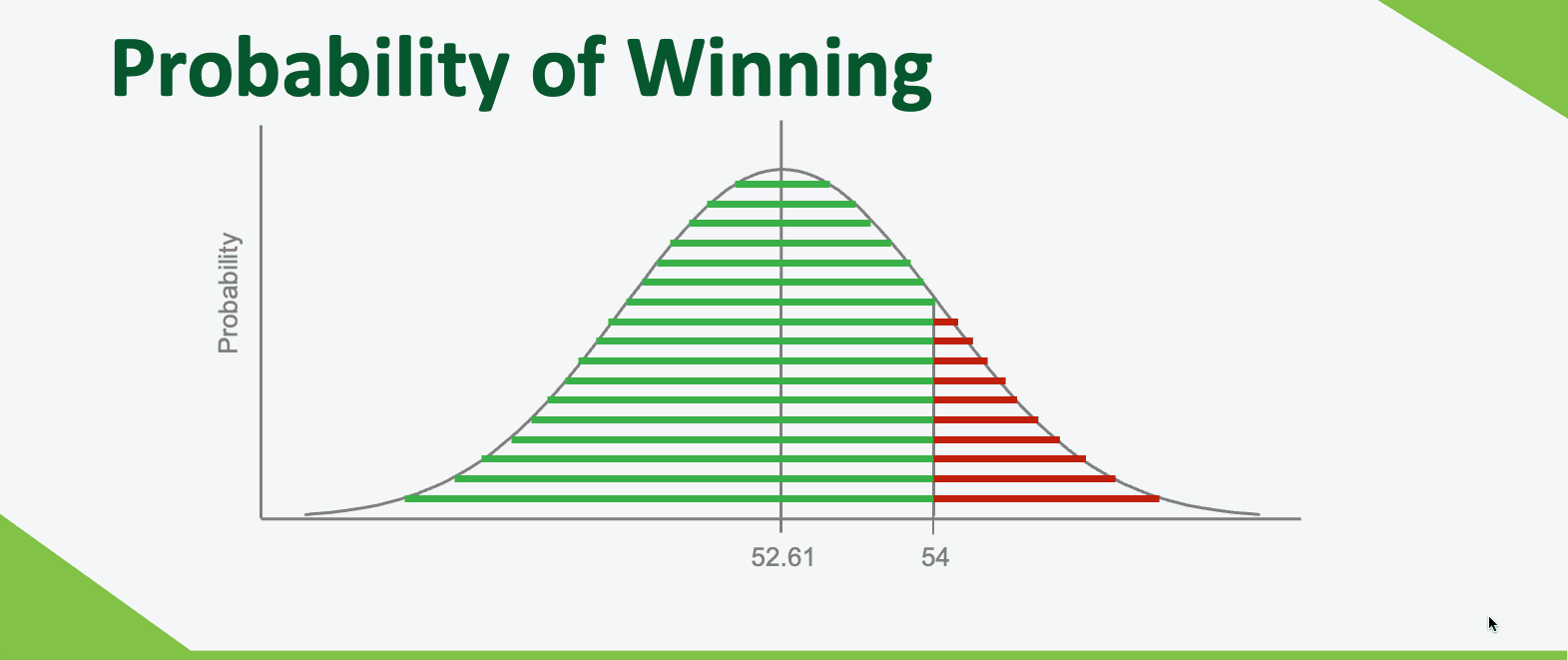

Just look at the chart below for a simple example.

In this case, the stock was at $52.61 when the trade was put on and we sold the $54 strike calls, so we had a head start in making money.

If the stock is at $52.61 and there’s about a 50% chance of it being lower at expiration, that 50% of occurrences would be winners.

Then for the other 50% of the time, when it goes up, a portion of that increase will be a winner too.

Only if it is trading far enough above the strike price at expiration does the trade lose. That’s why credit spreads are naturally high-probability trades.

And that's important...Because we don't make these trades just once.

We make them repeatedly to compound more wins over time...

This is how you turn a small account into a big account and a big account into, well, an even BIGGER Account.

GAINING AN UNFAIR ADVANTAGE: We see what the professional traders are doing right on our computers so we get their unfair advantages. Plus, we screen those trades with our own time-tested methodology to take the absolute BEST of the BEST!

Now before you can see the trades the institutions are making, consider what this looks like in real life...

Here's a simple example...

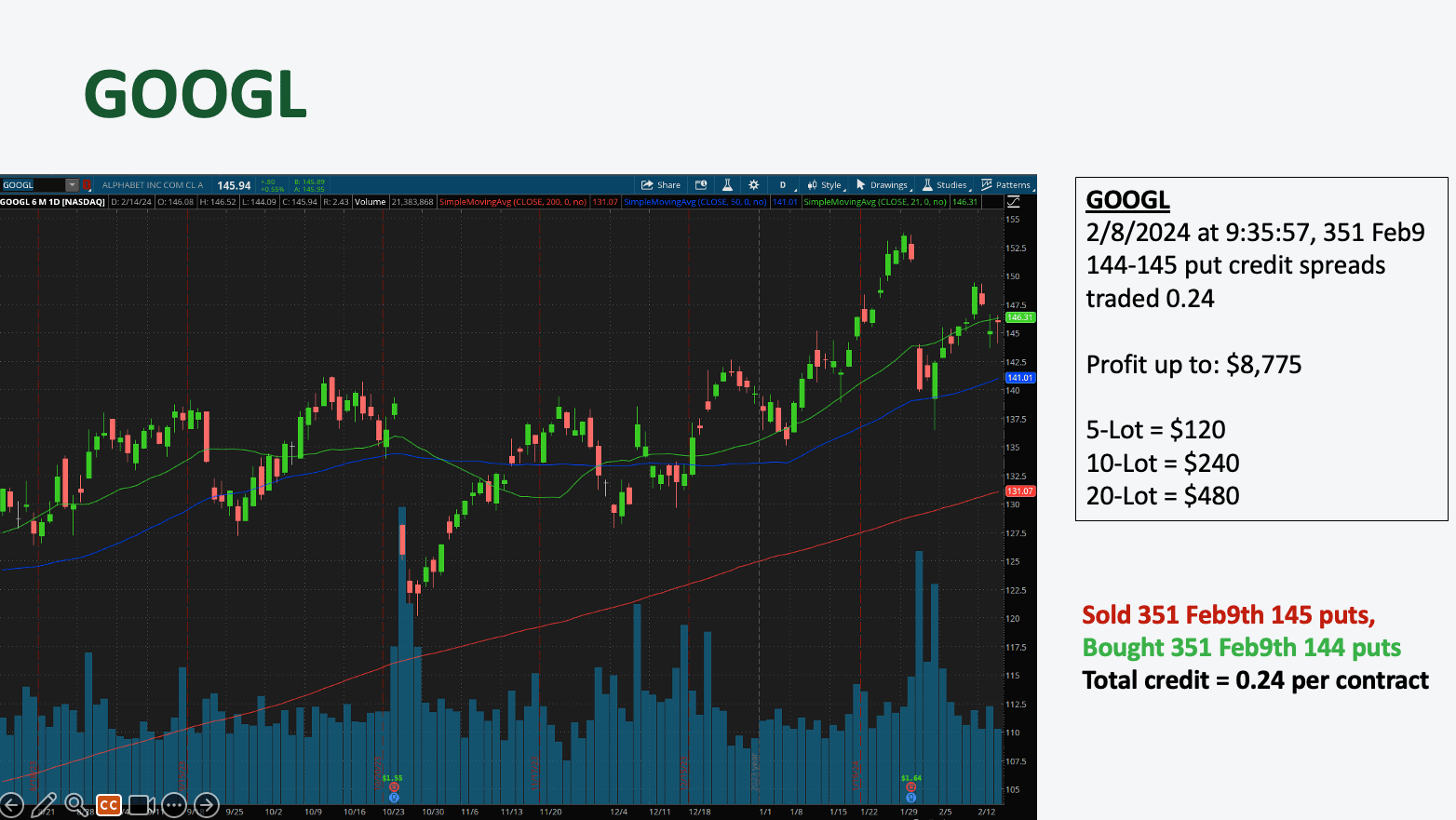

On February 8th at 9:35 and 57 seconds in Alphabet (Google), an institutional trader sold 351 of the February 9th 144-145 put credit spreads at 24 cents.

So that means the trader sold short 351 of the February 9th 145-strike puts and at the same time, as part of the trade also bought 351 of the February 9th 144 puts.

That's a put credit spread...Same expiration, two different strikes.

Now, because the 145 puts are a higher strike, they had more premium. Thus the trader took in a credit when the trade was made. In this case it was 24 cents per share...or $24 per contract (351 contracts total).

If the trader held this trade until expiration the next day, he or she could have made $8,775 at that time.

What if you were alerted about this trade the second it happened?

Well, a small trader following along and trading just 5 contracts could have added a quick $120 to his or her account.

You might not think that's much but...this is just one trade...Imagine doing this over and over. Day after day...week after week...

And as your account grows you increase the lot size. In this example, a 10-lot trader would have brought in $240 and a 20-lot trader could have made $480...In ONE DAY!

This is what we call a "Consistent Wealth-Building Activity."

Here's how we get the trades from the pros...

As an individual trader this information isn't available...you just can't get it without some help.

And that's where Dan Passarelli's connections come into play...

He started out as a runner in the pits of the Chicago Board Options Exchange.

He became a top trader there after only a few years of trading. He was hired by billionaire investor Steve Fossett to trade.

Then the Chicago Board Options Exchange asked him (and paid him) to teach other options traders how to trade. He was even sent on multiple trips to Asia to teach international traders.

Now, he has leveraged those connections to provide individual traders, traders like you...with data you can't find anywhere else.

In coordination with the Chicago Board Options Exchange, Dan put together the exact algorithm for these credit spreads. Over three decades of experience went into selecting the right metrics and parameters.

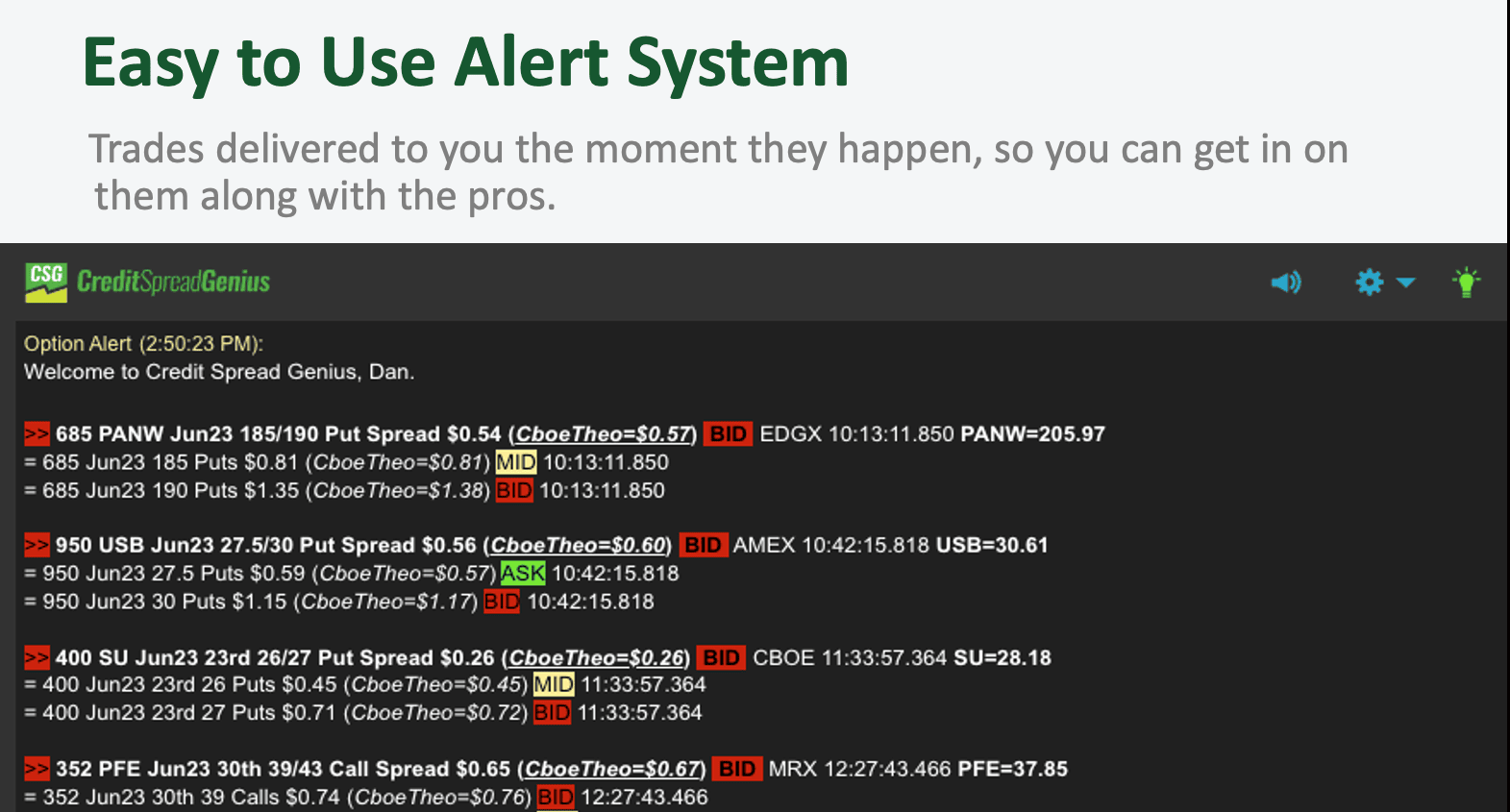

Together, the Chicago Board Options Exchange and Dan built, tested and refined what he calls Credit Spread Genius.

This system combines real time trade notifications from the Chicago Board Options Exchange with the proven methodology Dan has taught to tens of thousands of students worldwide.

The alerts are all browser based so you can receive them anywhere...on any device.

They populate in real time...as the trades are made.

You'll be following the smart money, so you never have to second-guess yourself in the market again. Or spend hours upon hours searching for the right trade.

You get password-protected access to real-time trade triggers sent directly from the Chicago Board Options Exchange.

Dan pulled some strings for you to be able to get this.

He negotiated a contract with the Chicago Board Options Exchange for you to get professional trade data you can't get from any other source.

As a professional in the field Dan pays for the data...not only is it expensive (about $7,000 per month) but it is not available to non-professionals at ANY Price...Until now.

And the best part is...it's all legal. When you sign up for Credit Spread Genius you'll be taken to an agreement that allows you to have this access as a non-professional.

Once you see the alerts come through...

All that's left is performing a few simple checks to determine if you'll make the trade or let it pass.

And the real beauty is it takes almost no time to make that decision with the proprietary methodology Dan teaches in the Credit Spread Genius Accelerator Course, which comes as a BONUS with the Credit Spread Genius Alert System.

In order for you to be extremely successful with Credit Spread Genius Dan also created a half-day on-demand bootcamp where you'll become an expert in the system.

And Dan is offering several additional bonuses to new members of Credit Spread Genius:

- Credit Spread Genius Accelerator Course

-

Credit Spread Genius 1/2 Day Bootcamp

-

The MTM "SpreadCheat" Trade Tracker

-

Monthly Office Hours with Dan

-

Direct Access to MTM Coaches in the MTM Community Chatroom

Scanners like this are an invaluable resource to traders.

The pro-traders we're following with Credit Spread Genius spend hundreds of thousands every month on the fastest terminals, the most up-to-date research and access to the best industry experts.

But you don't have to spend anywhere near that to access the EXACT trades they execute with all that expensive information.

You're probably thinking $3,000 per month would be a reasonable price to spend on this...

And you'd be right. Because let's face it, following just a few of these trades every day...or even a few a week if you have limited time to trade) could yield massive results.

Receiving the trades in real time is a game changer. Plus, all the bonuses that build trading confidence and consistency make Credit Spread Genius the perfect tool to add to your trading tool belt.

Today, for a limited time, you can access Credit Spread Genius for 90 Days for just $597.

That gets you all the bonuses. The scanner. The trade tracker. The half-day bootcamp. The Accelerator Course. Plus, monthly office hours and direct access to Dan Passarelli in the MTM Community Chatroom.

"I began using Credit Spread Genius, and so far so good. I've covered the cost of the quarter and then some in two days; I started with a very small number of contracts per trade. Thank you Dan Pass!!"

Yolanda F. Miami FL

Become a Credit Spread Genius Today Only $597/Quarter